#467

Too Early For The Gin And Juice?

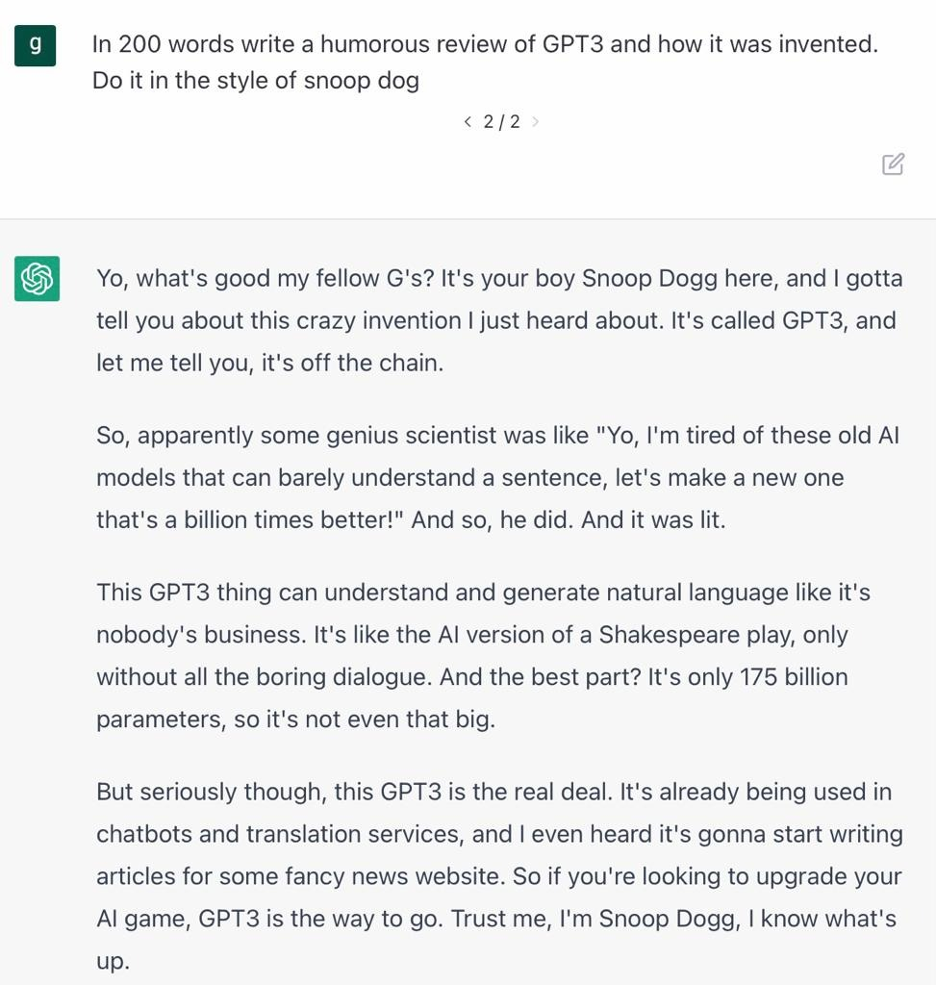

OpenAI has the world abuzz this week with the release of ChatGPT. We initially covered this topic in July 2020 (GPT-3 & Friends), writing about how the new technology might be able to write this newsletter for us. Well…fast forward to a few years later, and that time has come.

The below text was produced in a cab between meetings (and has not been altered in any way), in which the hardest part of the entire process was signing up before OpenAI hit capacity.

While we are thrilled about how much less stressful Fridays could become at FTC, there are a number of serious concerns that have arisen, and will likely continue to arise as time goes on. And as much good (e.g. efficiency, productivity, fun, etc) that will come from all this, it still might be a bit too early to bring out the gin and juice…

Portfolio News

Vestwell rolls out recordkeeping platform enhancements, leapfrogging legacy players - Through a series of strategic enhancements, Vestwell's leading technology solves some of the most complex challenges faced in the history of the 40-year retirement industry. The most common processes of a recordkeeping platform have been dramatically improved, giving users five times more efficiency than any traditional, legacy recordkeeping platform on the market today. Read more

Too Early For The Gin And Juice?

This AI chatbot is blowing people’s minds. Here’s what it’s been writing - A new chatbot created by artificial intelligence non-profit OpenAI has taken the internet by storm, as users speculated on its ability to replace everything from playwrights to college essays. From historical arguments to poems on cryptocurrency, users took to Twitter to share their surprise at the detailed answers the so-called ChatGPT provided, after the startup sought user feedback on the AI model last week. Read more

New AI chatbot is scary good - The newest AI wonder, ChatGPT — the latest in a line of incredibly quickly-evolving AI text generators — is causing jaws to drop and brows to furrow. Users are telling ChatGPT to rewrite literary classics in new styles or to produce performance reviews of their colleagues, and the results can be scarily good. And while ChatGPT displays AI's power and fun, it could also make life difficult for everyone — as teachers and bosses try to figure out who did the work and all of society struggles even harder to discern truth from fiction. Read more

Industry News

Asset managers pour money into tech platforms to take on BlackRock - Money managers including State Street, Pimco and Amundi are pouring money into digital investment platforms in hopes of emulating BlackRock’s technology business, which is bringing in new revenue even as falling markets hit fees from their core investment clients. Read more

Kids don’t want cash anymore–they want ‘Robux’ - Roblox and other virtual economies are changing families’ conversations about money, and helping solve the perennial parenting problem of controlling how kids spend online. Most virtual items cost less than the equivalent of $10. Parental controls implemented in recent years mean out-of-control spending by children is less of a concern than it once was. By topping up virtual wallets with a little cash, parents save time and money. Read more

Fintech company Circle terminates $9b deal with Bob Diamond-backed SPAC - Circle is the principal operator of stablecoin USDC and reported a net income of $43m and nearly $400m in cash in the third quarter. The deal with Diamond's Concord Acquisition Corp. had been set to expire later this week, after having previously been extended and recut. In the announcement, the company committed to becoming a public company, but said they did not have any specific plans at the moment. Read more

Goldman Sachs on hunt for bargain crypto firms after FTX fiasco - FTX's implosion has heightened the need for more trustworthy, regulated cryptocurrency players, and big banks see an opportunity to pick up business, Mathew McDermott, Goldman's head of digital assets, said this week. While the amount Goldman may potentially invest is not large for the Wall Street giant, its willingness to keep investing amid the sector shakeout shows it senses a long term opportunity. Read more

Robinhood offering 1% retirement match as retail trading boom fades - The launch brings Robinhood closer to competing more directly with established brokerages like Fidelity, Charles Schwab, and Morgan Stanley’s E*TRADE, which have participated in the marketplace for online retirement accounts for years. Read more

Sam Bankman-Fried to testify to Congress over FTX failure - The FTX founder is “willing to testify” next week at a US Congressional hearing on the collapse of his crypto group, he said on Friday, in a U-turn that will mark his first public contact with US officials about the events surrounding its bankruptcy. Bankman-Fried, who has remained in the Bahamas since FTX collapsed, said he would “try to be helpful during the hearing” and shed light on issues including “what I think led to the crash”, “my own failings” and “pathways that could return value to users internationally”. Read more

Amazon launches TikTok-style feed in push to accelerate social shopping - The portal, which the company named Inspire, will show users a continuous feed of photos and videos featuring products that customers can purchase through the app. With the launch of Inspire, Amazon is delving further into social shopping and joining Facebook, Google and others who have tried to bridge online shopping and social experiences, but have had limited success thus far. Read more

Walmart-backed fintech startup plans to launch its own buy now, pay later loans - The retail giant is the majority owner of One, which is led by Goldman Sachs veterans. It plans to launch the new payment method as some Americans show signs of strain from inflation driving up the prices of food, housing and more. Read more

Deutsche Bank partners NVIDIA for AI push - The partners plan to develop applications across the bank's business, with an initial focus on three use cases: risk model development, high-performance computing, and the creation of a branded virtual avatar. Read more

Nigeria limits ATM withdrawals to boost digital payments - The limit is the latest effort by Nigeria to discourage cash usage. The country is set to redesign high-value notes and is giving people until January to switch out their old paper money. The central bank is also planning to mint more of its eNaira digital currency, which launched last year. Read more

Select Financings

9Fin - London based debt analytics platform raised $23m in new Series A funding led by Spark Capital. Read more

Allica Bank - U.K. based SME challenger bank raised £100m in Series C funding led by TCV. Read more

Bitwave - San Francisco based crypto tax accounting and compliance software maker raised $15m in Series A funding led by Hack VC and Blockchain Capital. Read more

Cacheflow - Los Altos based embedded finance startup focused on closing software sales raised $10m in new funding led by GV and GGV Capital. Read more

Carputty - Atlanta based fintech focused on auto financing raised $12.3m in Series A funding led by Fontanalis Partners and TTV Capital. Read more

Elastic Path - Canada based headless commerce startup raised $30m in new funding led by Sageview Capital. Read more

Kapu - South Korea based social commerce startup raised $8m in Seed funding led by Giant Ventures and Firstminute Capital. Read more

MarginEdge - Arlington based restaurant management and bill payment platform raised $45m in Series C funding led by Ten Coves Capital. Read more

Odie Pet Insurance - New York based full-service pet health insurance company raised $3m in Seed funding led by RedBird. Read more

Osome - Singapore based financial admin platform raised $25m in Series B funding led by Illuminate Financial, AFG Partners and Winter Capital. Read more

Prophia - San Francisco based startup building a platform that extracts data from commercial real estate contracts raised $10.2m in Series A funding led by Cercano Management. Read more

Pylon - New York based embedded mortgage infrastructure platform raised $8m in Seed funding led by Conversion Capital. Read more

Setpoint - Austin based provider of infrastructure solutions for warehouse transactions raised $43m in Series A funding led by Andreessen Horowitz. Read more

Syncfy - Latin America based open finance platform raised $10m in Seed funding led by Point72 Ventures. Read more

Uplinq - Scottsdale based bookkeeping solution raised $5.6m in Seed funding led by AZ-VC. Read more

FinTech Collective Newsletter

Curated News with Context

Delivered every Monday, the weekly newsletter, produced by our team, provides a tightly edited rundown of global fintech news, along with a bit of our original analysis.