#391

Cryptopendence Day

Is June 9th Cryptopendence Day? For the first time, Bitcoin has become a country’s legal tender, announced by backward-hat-wearing millennial Salvadorian President Nayib Bukele.

Legal tender means that Bitcoin, along with the US dollar - the official currency since 2001 - now “must” be accepted as a form of payment for goods and services across the country. This law will be going into effect in 86 days, at a Bitcoin/dollar exchange rate set by the market. Panama and Paraguay are in discussions to follow suit.

The volatility of Bitcoin brings El Salvador’s decision into question, but this event is a considerable step for both Bitcoin and other cryptocurrencies, proving increasing legitimacy. Bitcoin rose about 17% the day following El Salvador’s decision, which highlights its volatility and single-event fluctuations.

70% of El Salvador’s population lack access to basic financial services, and the economy relies heavily on remittances (representing 23% of GDP). Proponents argue that the upside case for access trumps the uncertainty.

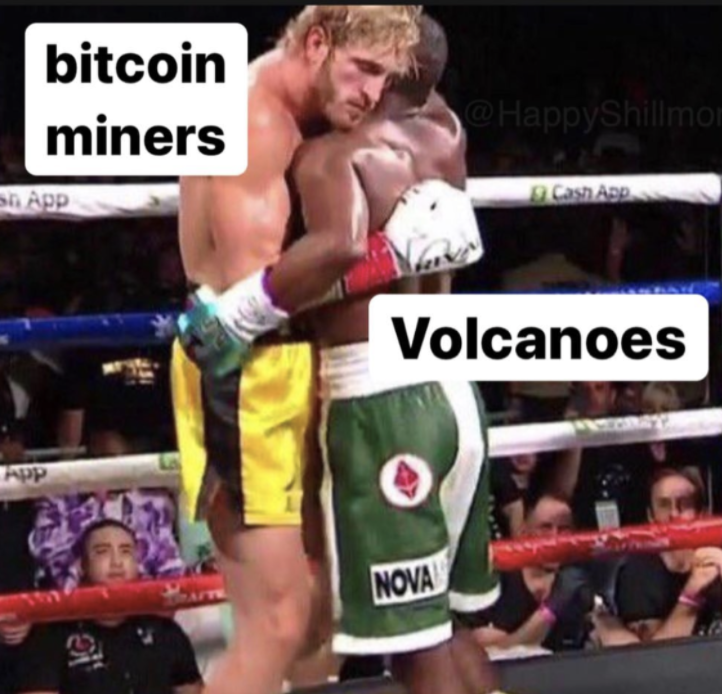

To support such widespread use of Bitcoin, Bukele suggested using geothermal energy to develop Bitcoin mining facilities from the country’s volcanoes, emulating Iceland’s Bitcoin mining industry, which accounts for 8% of all Bitcoin mining in the world.

Whether or not this trend gets adopted by other governments, it surely will continue to be energy-intensive, both in mining and memes.

|

Cryptopendence Day

Using electricity generated from volcanoes to mine Bitcoin - The president of El Salvador announced Wednesday that the country's state-run geothermal energy utility would begin using power derived from volcanoes for Bitcoin mining. Read more

El Salvador becomes first country to adopt bitcoin as legal tender after passing law - Lawmakers in the Central American country’s Congress voted by a “supermajority” in favor of the Bitcoin Law, receiving 62 out of 84 of the legislature’s vote. Read more

Industry News

|

Select Financings

Airbase - San Francisco based spend management platform for SMBs raised $60m in Series B funding at a $600m valuation led by Menlo Ventures. Read more

Blooma - California based digital underwriting platform for commercial real estate raised $15m in Series A funding led by Canapi Ventures. Read more

Branch Insurance - Ohio based home and auto insurance startup raised $50m in Series B funding led by Anthemis Group. Read more

Briq - California based payment platform for the construction industry raised $30m in Series B funding led by Tiger Global. Read more

BukuWarung - Indonesia based accounting platform for SMEs raised $60m in Series A funding co-led by Valar Ventures and Goodwater Capital. Read more

Certificial - New Jersey based certificate of insurance and compliance management software raised $5.8m in Series A funding led by IA Capital. Read more

Clip - Mexico digital payments and commerce platform raised $250m in Series D funding at a $2b valuation co-led by SoftBank and Viking Global Investors. Read more

Klarna - Sweden based online payment platform raised $639m in new funding at a $45.6b valuation led by SoftBank Vision Fund 2. Read more

Ledger - France based gateway for digital assets raised $380m in Series C funding at a $1.5b valuation led by 10T Holdings. Read more

Nubank - Brazil based challenger bank raised $750m in Series G funding (total round is $1.15b) at a $30b valuation led by Berkshire Hathaway. Read more

Pennylane - France based accounting platform for SMBs raised €15m in Series B funding led by Sequoia Capital. Read more

Refyne - India based earned wage access startup raised $16m in Series A funding led by RTP Global. Read more

Scalable Capital - Germany based trading app for Europe raised $180m in Series E funding at a $1.4b valuation led by Tencent. Read more

Trellis - San Francisco based car and home insurance startup raised $10m in Series A funding led by QED Investors. Read more

Trulioo - Canada based online identity verification platform raised $394m in Series D funding at a $1.75b valuation led by TCV. Read more

Ziina - Dubai based P2P payments startup raised $7.5m in seed funding co-led by Avenir Growth and Class 5 Global. Read more

FinTech Collective Newsletter

Curated News with Context

Delivered every Monday, the weekly newsletter, produced by our team, provides a tightly edited rundown of global fintech news, along with a bit of our original analysis.