Looking at the future of LatAm digital payments through the lessons of China

Published:

Mar 09, 2023

Authors:

Carlos Alonso Torras (FinTech Collective)

Cristobal de Atucha (FinTech Collective)

Wenyi Cai (Polymath Ventures)

Shuang Bin (Polymath Ventures)

Share:

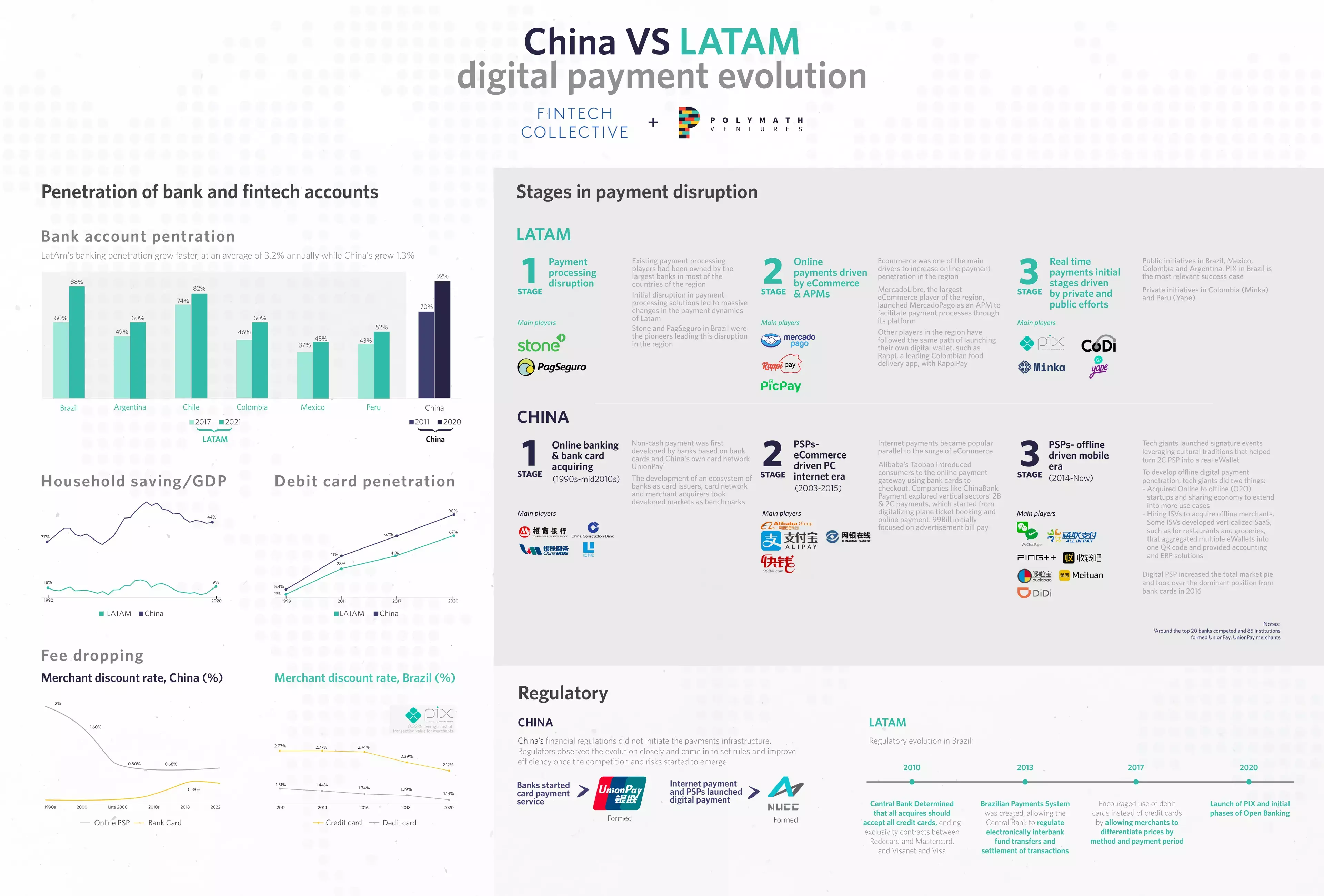

When analyzing the development of financial technology in emerging markets, it’s arguably more useful to examine precedents in other, previously emerging regions, rather than simply in developed markets.

Hence, we looked eastward toward China to help us better understand the current state of the payments landscape in Latin America. From the outset, it’s clear that certain fundamental differences exist between the two regions, foremost of which is arguably the level of homogeneity and centralization enjoyed by China. Yet, upon closer inspection and after analyzing the evolution of payments across three different dimensions (alternative payments, the “merchant acquiring battle”, and real-time payments infrastructure), we conclude that there are lessons from the Chinese example that can be helpful in anticipating future developments in Latin America.

In the merchant acquiring “battle”, it’s undeniable that most payment volumes processed still come from offline retailers in LatAm. The heavy lifting displayed in China while transitioning merchants from offline to online via a massive on-the-ground effort likely foreshadows efforts to come in Latin America, after the impetus of an initial, pandemic-induced “push to digital”. Looking ahead and into alternative payment methods, in China, this success story started 20 years ago on the back of a surge in e-commerce, under the backdrop of already significant banking penetration. Alternatively, LatAm seeks to fight this battle both via well-funded tech players and traditional banking, or even retail, distribution networks. Given its population is significantly less digitally native, fragmentation can be expected. Lastly, while the role of government might seem like a major difference between China and LatAm (techno-capable, centralized behemoth versus several imperfect democracies), in both cases, proactive public sector resources and coordination have been vital for rapid progress in payment digitization.

Alternative payment methods

China’s digital wallet success story started with the surge of eCommerce in the 2000s, under the backdrop of already-decent bank account penetration. However, leading players also took into account cultural elements to upgrade the perception of digital payment from a channel tool into a wallet-feeling product. Alipay introduced high-interest rate saving plans (MMF) in 2013, leveraging people’s saving habits and an inflationary market. Within one year, it acquired more than 100M users and the balance of the mutual fund reached 574B RMB1. As a result, the majority of Chinese started to consider Alipay as a more serious eWallet account. WeChat, following competitor Alipay‘s step in spring 2014, introduced “online red envelopes” during the Chinese New Year (red envelopes containing money are traditionally exchanged between family members and friends to express good wishes for the coming year), leveraging the social tradition and WeChat’s instant messaging advantage. Wechat Pay gamified and popularized P2P transfers among its existing 500M users and quickly became a hit. It acquired 8M payment users via 40M red envelopes overnight, and over 100M users were persuaded to bundle their bank accounts with Wechat payment accounts after the holiday2. In summary, the Chinese example shows that the fast penetration of such a massive market rested on the internet giants’ existing market coverage - as well as clever product marketing - to generate efficient and sticky adoption.

Akin to what led to the massive adoption of digital wallets in China, the ones paving the way to analogous digitalization in Latin America also rely on the structural cultural roots of the region, although different ones. These roots are in the lack of trust in financial institutions, which has been one of the main headwinds for “bankarization”, as individuals have historically suffered from high fees and interest rates. This leaves room for more convenient and lower-cost alternatives to disrupt the landscape.

In recent years, we have seen a significant penetration of digital banks and “alternative payments methods” (APMs) in LatAm. As of 2022, APMs have been a strong eCommerce payment method with a 39% share of the total volume transacted online, representing over $400b in transacted value3. One of the most popular APM is digital wallets, which are expected to represent 10% of the total eCommerce volume over the following years, and grow at a 20% annual growth rate through 2025.4 In many countries in LatAm, the adoption of APMs is obvious because they are easier and faster to use than a banking option, and in some cases offer benefits such as cashback and rewards on their platforms. Among the fastest growing APMs, we have seen a surge in account based transfers proven by the success of real-time payments adoption in the region. For example, Brazilian payment app PicPay captured over 60m customers in the country, representing ~28% of the Brazilian population.5 In Colombia, PSE6 payments became one of the most popular payment methods, representing ~35% of online purchases in the country, ahead of the ~30% share of credit cards.7 Additionally, we have seen tech companies with a significant user base start offering financial services, as seen in the case of Rappi across the region gaining significant market share through its different fintech arms in Brazil, Colombia, Peru and Mexico. In Colombia, the company started operating as a digital wallet and has recently received approval to operate as a digital bank, being able to offer deposit and savings services through its own platform RappiPay.

Merchant acquiring battle

In China, transactional flows through offline merchants have always been significantly larger than eCommerce, and it still remains the case. However, only very sizable merchants were considered relevant by the bank-dominated payment industry before the introduction of eWallets. The digital payment battle for offline merchants in China intensified after 2014 when AliPay and Wechat Pay trained users to use eWallets as real wallets. As the most convenient avenue through which to push digital payments beyond eCommerce, they widely and strategically invested in the newly emerging O2O (online to offline) startups, such as Didi, bike sharing companies, and delivery services that allowed digital payment partnerships. This was typically done via their corporate venture capital arms, usually including special terms of payment exclusivity.

A low merchant discount rate (MDR, which refers to the payment processing fee charged to merchants) is crucial in getting SMEs onboard. Both Alipay and WeChat offered rates lower than those of banks, and actually nearly waived these fees to onboard as many offline merchants as possible during their initial years. WeChat got an upper hand in initial merchant acquisition by hiring independent software vendors (ISVs) to penetrate amongst small to medium merchants. ISVs offered better account reconciliation services and vertical solutions to digitally underserved small merchants. These ERP-based ISVs then evolved to become important payment aggregators and SaaS companies, such as Mwee (serving restaurants), ShouQianBa (serving grocery stores) and thousands of ISVs specialized in many other consumer industries. Now, the MDR has recovered to a more stable 0.38% of the total transaction amount.8 Volume determines the profitability for payment companies, implying that it’s a tech giants’ game, but many services around payment also thrive under the main umbrellas. The development path in China may shed light on how to approach merchant acquiring in LatAm’s massive offline space.

Although we have seen a major adoption of digital payments in the past years in LatAm, the majority of payment volumes processed still come from offline retailers. This sector has been historically dominated by the largest banks, having a significant ownership stake in the largest processors of each country. In the past 10 years, we have seen the entrance of disruptors such as PagSeguro and Stone in Brazil to challenge the incumbents and gain significant market share. The combined market share of traditional acquirers Cielo and Rede has been compressed from ~90% in 2014 to ~50% in 2021.9 The entrance of PagSeguro and Stone combined with certain initiatives from the Brazilian Central Bank, such as the creation of the Brazilian Payments System, led to a democratization of the access to payments, as seen by the decrease of the merchant discount rate (MDR). The MDR of both credit and debit cards has been constantly decreasing in the past years, creating entry barriers for any player wanting to enter the system, as companies need considerable payments volume to be profitable in the long term.

As more players are operating in the space with distinctive strategies to capture a share of this massive opportunity, we are also going to see more innovative payment solutions at the offline retailers channel while competition increases. An example of a recent innovative solution is NuTap, launched in May 2022 by Nubank in Brazil, which allows merchants to accept credit or debit payments directly on their cell phones. Moreover, in the past years, we have seen how MercadoLibre’s fintech arm MercadoPago has innovated in the offline channel through its QR payment solution, in order to capture offline transactions. It has also added a merchant acquiring solution in some countries, ensuring presence across the whole payment value chain.

Role of government in payments infrastructure

Often, the role of government is cited as a major difference between China and Latin America. However, our observation demonstrates that, in both, a proactive governmental framework and infrastructure is important for rapid progress in digital payments adoption.

China’s financial regulator is famous for keeping a loose eye on the development of the private sector and then tightening the rules and building a more standardized framework. UnionPay, the card network, was formed to rectify the situation after the top 20 banks aggressively pushed their own POS terminals to shopping malls counters. The national efforts in building infrastructure layers often came in to increase the overall efficiency by setting rules and leveling the playfield for all players, reducing chaos and monopolies. In the payments infrastructure space, previously, all the major eWallet companies built systems connecting with each of the main banks. After 2017, the regulator required all players involved in nonbank third-party payments to connect and clear with banks through NUCC. By doing so, the payment portal and agreements became standardized and unified across institutions, which saved particularly small banks and payment players from the burden of heavy technology development work. It’s worth noting that the possibility of creating a company like NUCC - which was jointly founded by 45 shareholders, including 29 competing PSPs and regulatory bodies10 - might be unique to China’s centralized governance. However, we can see alternative examples of government proactive intervention already working in Latin America.

We are seeing that the next generation of payments infrastructure innovation in the LatAm region will be driven by a collaboration of public and private agents, as well as cross-border cooperation. The real-time payments network development in the region shows both coordinated public efforts as in the case of Brazil (PIX) and private efforts building the underlying infrastructure needed for their countries as in the cases of Colombia (TransfiYa, powered by Minka) and Peru (Yape). The latter is a nuanced case, as it highlights the potential of interoperability mandates by governments, as opposed to outright infrastructure development via the Central Bank. Launched in November 2020, PIX was developed by the Brazilian Central Bank as the national instant payment system for individuals and businesses. The adoption of PIX in Brazil has been a massive success since its launch, reaching 1B transactions per month in just 11 months, in comparison to India’s real-time payment system UPI that took 44 months to reach the same number.11 This success story is inspiring many countries in Latin America to follow the example, and in fact, PIX itself has begun efforts to export its technology.

Additionally, we are starting to see the influence of this success story not only across the region but also across the globe, proving that the Brazilian payment system is one of the most developed in the world. The Brazilian PIX has inspired the US Federal Reserve to launch its FedNow initiative as the first new payment rails in decades and allow bill payments, paychecks, and other money transfers to move instantaneously.

On the other hand, we have seen initiatives in Latin America that did not see the same level of traction as PIX. Launched in 2019, Mexican real-time payment initiative CoDi was severely impacted by the pandemic. The fact that the vast majority of merchants and several top banks refused to work with the Central Bank’s solution halted CoDi from gaining traction in the country.

Conclusion

Putting the comparison in perspective, it’s evident that some takeaways from the Chinese case are materially foreign to what we can expect going forward in Latin America. Yet some parallels do appear relevant. For instance, in the alternative payment methods space, it is unlikely that LatAm, as a region, will exhibit the type of concentration that China did. Certainly not at the same speed. After all, with well-funded tech players (above all Mercado Pago, but worth mentioning NuBank, or perhaps even Rappi) securing licenses, and existing financial institutions having created digital solutions as extensions of their operation (Bancolombia was early to this trend via Nequi, for instance), a more fragmented outlook remains likely.

Secondly, it holds comparatively true that low discount rates are crucial in getting SMEs onboard en masse. Well funded, new players are able to apply this downward pressure and catalyze massive adoption. Brazil proves it is possible, but whether it will happen remains less clear in Mexico and Colombia. In China, it was possible to hire independent software vendors (ISVs) to achieve innovative payment solutions at the offline retailer's channel. In Latin America, while the need for physical touchpoints is clear by now, scaling such an operation efficiently will likely require taking a page from the distribution playbook of some of the large (and less agile) industrial conglomerates.

Lastly, from a government infrastructure perspective, Brazil is most similar to China in that it can afford to build the pipes itself through public sector resources. Other countries will need private sector providers to work in tandem through public-private partnerships (likely via their Central Banks, to ensure a strong enough implementation mandate, or via interoperability requirements). Disrupting strong vested interests solely via private enterprise seems like an unlikely affair, if we consider the initial traction of TransfiYa in Colombia, for instance.

The lessons from China's digital payments evolution shed light on the future development pathways and necessary enablers for LatAm to transition to digital payments dominating the landscape of consumer and small business transactions. We are eager to continue participating and investing in this path for the region.

Notes

1 http://sd.ifeng.com/yantai/licaiguwen/detail_2014_07/04/2539633_0.shtml

2 https://www.fastcompany.com/3065255/china-wechat-tencent-red-envelopes-and-social-money

3 Beyond Borders 2022/2023. Digital payments connecting businesses and people in rising economies. (EBANX)

4 AMI (Americas Market Intelligence)

5 PicPay company website

6 Allows allows users to pay directly from their bank account in real time and without a credit card

7 AMI (Americas Market Intelligence)

8 Ireaserch, 2021 Research Report Third Party Payment Industry in China: https://news.iresearch.cn/content/202108/392053.shtml

9 Brazilian Association of Credit Cards and Services (ABECS)

10 NUCC is set up to organize the payment industry. By ChinaTimes 2017: https://finance.sina.cn/2017-08-07/detail-ifyitayr9592281.d.html

11 Brazilian Central Bank and National Payments Corporation of India